What is a credit score?

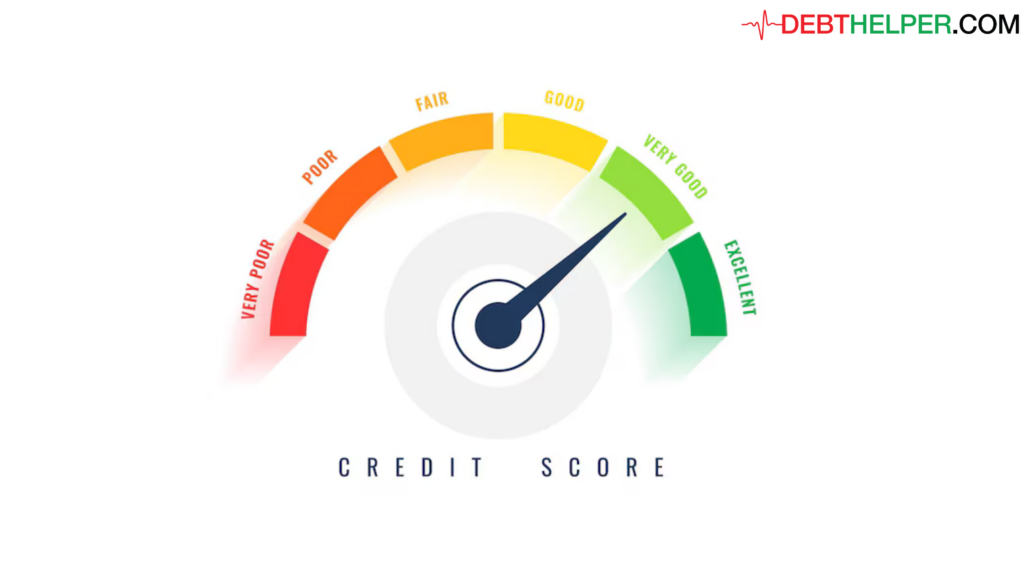

A credit score is a number that lenders, landlords and prospective employers use to predict how an individual will handle obligations like repaying a loan or paying rent on time.

How is my credit score used?

When you apply for credit, the lender uses your FICO score to measure risk in deciding whether to approve the application, what interest rate to charge and the credit limit. Later on, the lender may look at your FICO score again to decide whether to increase or decrease your credit limit.

Potential employers may use your FICO score to evaluate you as an employee. Many landlords consider your credit score to decide whether to rent to you and how big your security deposit will be.

What determines my FICO credit score?

Your FICO score is based on bill-paying history, debt profile, and other statistical information. For particular groups, like people who have not been using credit long, the importance of these categories may be somewhat different.

* 35% of your score is based on your payment history. Making payments on time is extremely important to your credit score. One expert cited that the average score of a consumer that pays their bills on time 100% of the time is 706. Just one percent of difference in that statistic, 99%, lowered that average score to 658.

* 30% is based on your amounts owed in proportion to your total credit limit, or your credit utilization ratio. A good rule is to keep your balances under 30% of your credit limit.

* 15% is based on the length of your credit history. This is something that can only improve with time, so a recent college grad with a limited credit history will have to be patient to see their score improve. Experts recommend keeping your first credit card open, even if it has a high interest rate, and using it enough to avoid cancellation by the card issuer.

* 10% is based on new credit as a gauge of whether or not your credit is expanding. Opening new accounts gradually over time will increase your credit score, provided you pay your bills on time. However, applying for too much credit at once can hurt your score.

* 10% is based on the types of credit you use. Utilizing credit cards, mortgages and car loans can help your score.

What affects my credit score and what doesn’t?

All of the things that affect your credit score show up on your credit report. Payment history, percentage of credit used (amounts owed), length of credit history, new credit, and the diversity of your credit, all appear in your credit report.

Checking your own credit report does NOT lower your score. On the other hand, when you apply for credit and the creditor reviews your credit report, that is called a “hard inquiry” and may lower your score.

How can I get my credit score?

You can get your credit score from any of the three credit reporting agencies, Equifax.com, Experian.com, and Transunion.com, you may have to enroll in and pay for a subscription service in order to see your score.