By J.J. Montanaro

USAA Certified Financial Plannerâ„¢ Practitioner

Originally published in Military Spouse Magazine

I was chatting with a colleague the other day about a big challenge in our work as financial planners. Frankly, there’s not a lot of new stuff out there when it comes to giving guidance about helping people manage their money. It’s more about packaging the principles in a way that helps make the fundamentals take root and grow into sound family financial practices.

Then I had a chat with Debi, a military spouse who is part of the Accredited Financial Counselor program. She told me about a class she was presenting on her installation. At the core of her presentation was the idea of creating a spending pie — a guideline to assess if your spending habits are a help or hindrance as you strive for personal financial freedom. Voila — an idea for this month’s column! Thanks Debi.

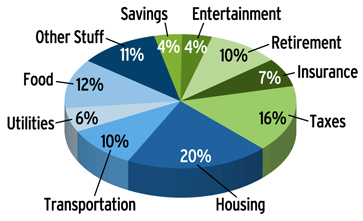

If you want to see how Americans spend their money, check out the annual Department of Labor Consumer Expenditure Survey. However, my goal here is to map out some guidelines as to where your money should go, not where it actually goes. Using an annual household income of $60,000, here’s how I broke it out on a monthly basis:

20% Housing ($1,000/month): This includes the core of what it takes to put a roof over your head. Mortgage (principal, interest, taxes, and insurance) and/or rent. This may be lower than what a lender will lend, but too many folks are house rich and cash poor. Check that, they were house rich.

10% Transportation ($500/month): That’s car payments, gas, repairs and whatever it takes to get from work to home and everywhere else you go.

6% Utilities ($300/month): Electricity, gas, garbage, water, cell phones, cable or satellite are all items that fall in this slice. Seem low? You don’t need all the extras! This is typically an area where savings can be realized.

12% Food ($600/month): This is what it takes to put food on the table, in the lunchbox, the school cafeteria, or unless you’re calling it entertainment, on the town.

11% Other Stuff ($550/month): This could include clothes, charitable contributions and the other expenditures not covered by our other categories. Sports for kids or vacations may come from here.

4% Short-term Savings ($200/month): This is what should be going into your emergency fund each month. In reality, this is money that you have to come up with for all life’s surprises — like that big vet bill for Fido or that water heater that just died. By setting aside money each paycheck you can avoid debt when something unexpected comes up and then automatically refill the account to rebuild your reserves.

4% Entertainment ($200/month): Who says financial planners aren’t fun? Hopefully, there’s a financial date night in your mix that includes stuff like movies, dancing and whatever makes you smile.

10% Retirement investments ($500/month): This is money set aside for your long-term goals. This includes contributions to the Thrift Savings Plan or a Roth IRA.

7% Insurance ($350/month): Life, health, auto, renters and whatever it takes to put together a comprehensive package of insurance (except homeowners which falls under housing) to protect you and your family. Health coverage is a major benefit of military service so you may have to carve out more for this category when you leave the military.

16% Taxes ($800/month): It’s easy to forget about them, but they’re everywhere. Income tax, sales tax, personal property tax and even capital gains tax (though given the housing and stock markets, it might be tough to remember what those are!).

So there you have it, my take on where your money should go. Is this the right mix for everyone? Of course not, but the key takeaway here is to understand where your money ends up each month. A cursory review of this pie chart drives home the importance of making sure you don’t overspend on the big-ticket items. If you’re driving cars that take up 25% of your income, the fact that you bypass the coffee shop on the way to work will not assure your long-term financial health. Look at how you’re slicing your pie and adjust accordingly.

Conspicuously absent from my pie are debt payments beyond a home and a car. In my mind, that’s the way it should be, even if it’s not reality for many folks. If you’re working on digging out of debt, it makes this budget pie exercise all the more important. You’ve got to trim across the board to “find money” to direct toward eliminating debt.

Finally, although it may be obvious, one thing that struck me as I mapped this all out was that if you could tap into your increasing income over the years to expand your savings and investments instead of lifestyle, you’d go a long way toward securing your financial future. And financial security tastes good in whatever flavor you fancy.

Source